Loan Options

Powered by Mpire Financial Group, LLC

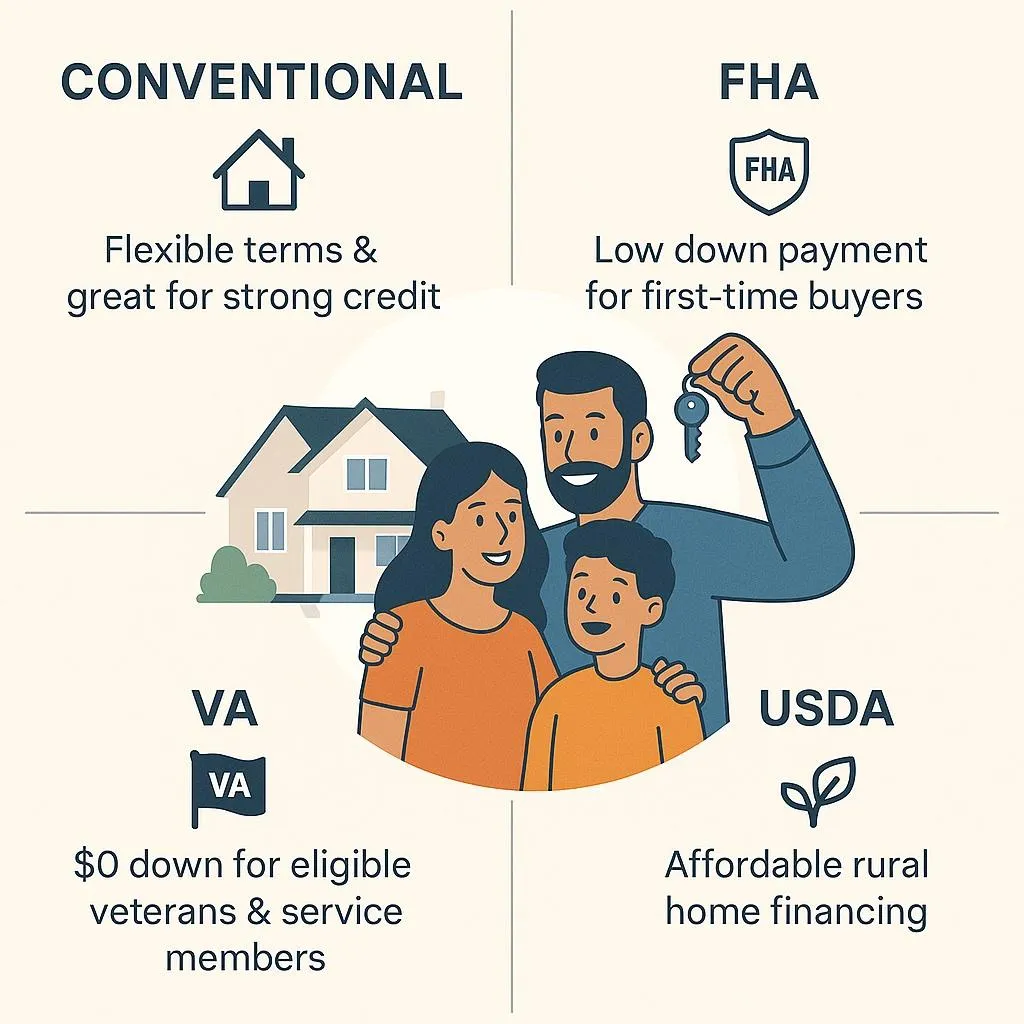

LOAN PRODUCTS

CONVENTIONAL, FHA, VA, & USDA

A seamless home loan process from pre-approval to welcome home celebration.

Teaming up with Merrily Brown, an independent mortgage broker, will help you meet your needs with technology and speed. With one credit review and a mortgage application, Merrily can shop multiple lenders to find the loan to fits your needs.

As an independent broker, Merrily has direct access to some of the most competitive wholesale rates in the country, potentially enabling you to get a bigger, more expensive home with a lower monthly payment.

Once the mortgage that meets your needs is chosen, Merrily utilizes her industry expertise to guide you through the process. With safe and secure technology, Merrily offers digital mortgage tools that empower you to securely communicate and submit documents from anywhere.

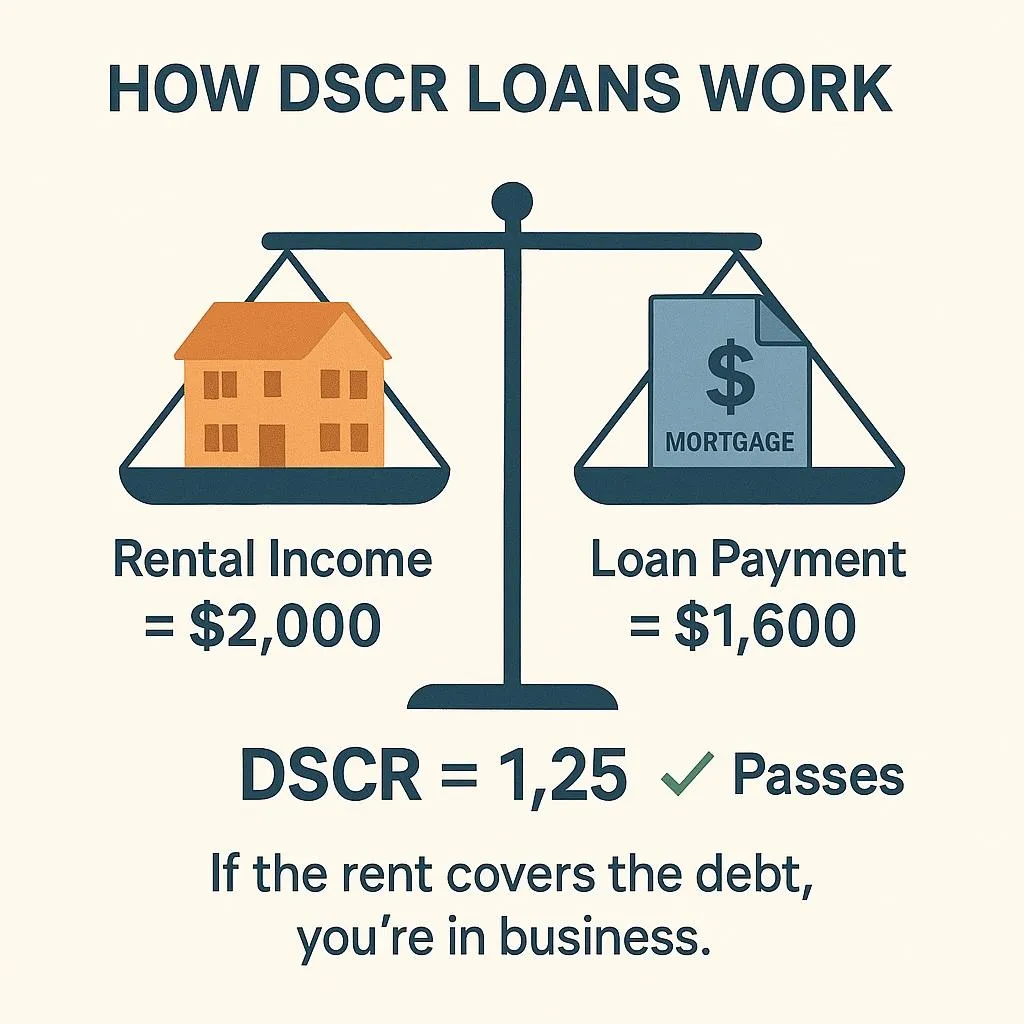

DSCR - Debt Service Coverage Ratio

DSCR Loans: Let the Property Qualify, Not Just You

A DSCR (Debt Service Coverage Ratio) loan is designed specifically for real estate investors. Instead of focusing on your personal income, this loan type looks at how much rental income the property generates compared to its monthly debt payments.

If the property brings in enough to cover the loan, you may qualify — even without traditional income documentation. It’s a powerful way for investors to

leverage income-producing properties

to grow their portfolio.

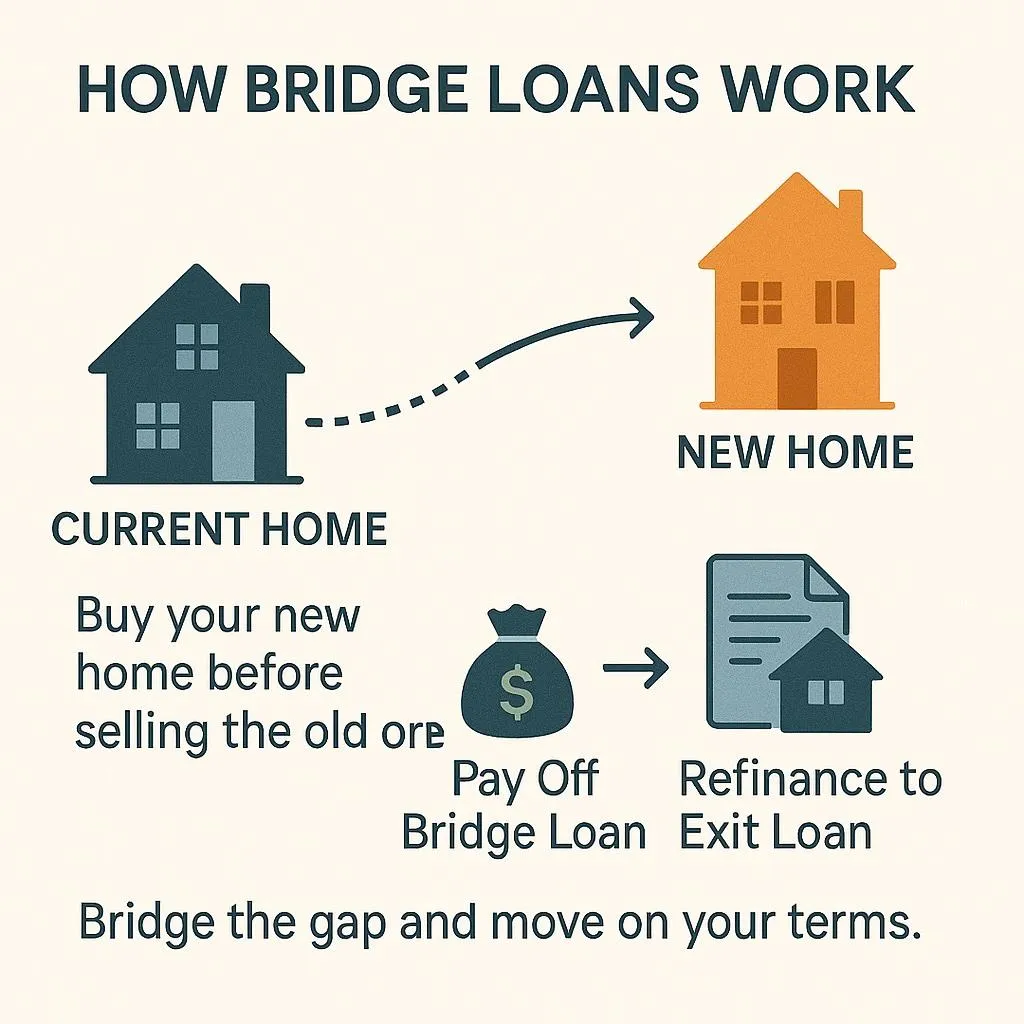

BRIDGE LOANS

Bridge Loans: Buy Before You Sell

A Bridge Loan helps you purchase your new home before your current one sells — giving you the flexibility to move forward without waiting.

When the loan term ends, you’ve got options:

Pay it off using the proceeds from your home sale or other funds,

OR

Refinance into a long-term mortgage (also called an Exit Loan), reducing the amount owed with the equity from your previous home.

Bridge loans are perfect for homeowners who need speed and flexibility in today’s competitive market.

LET'S CONNECT